©2024 OnPay, Inc.

Insurance offered through OnPay Insurance Agency, LLC (CA License #0L29422)

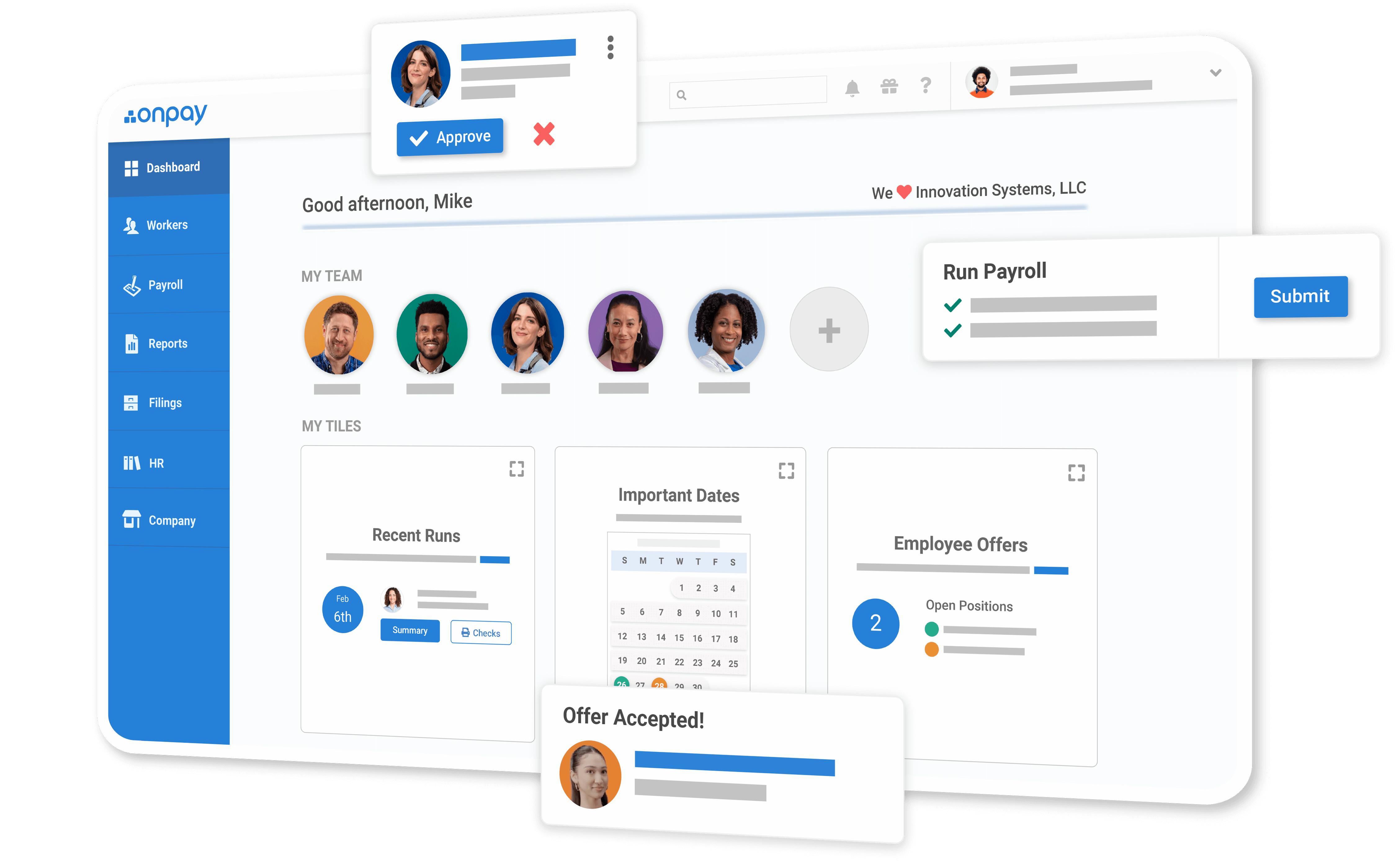

We give you everything you need to handle payroll, HR, and benefits with confidence — so you can get down to business.

Forbes

PCMag

CNBC

The Ascent by Motley Fool

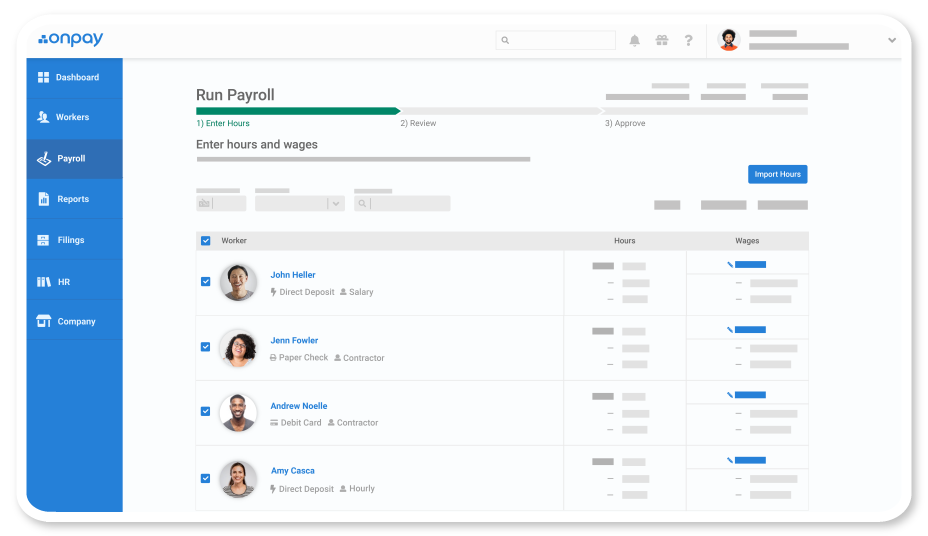

Fast, precise, and backed by payroll experts, we’re the only payroll company you’ll ever need.

OnPay simplifies paying and managing your team — so you have more time to focus on what you do best.

Thousands of small businesses count on OnPay to run payroll and simplify back office tasks.

from Capterra, G2, and TrustPilot.

Every OnPay client gets the VIP treatment. We handle all of the setup and data migration to get you started. And if you ever need help, our team of trained payroll pros is easy to reach. They really know their stuff (and they’re great folks).

For one monthly price of $40 + $6 per person you’ll get more than any other provider offers. No surprises or added fees, ever.

If you ever need help, our team of trained payroll pros is easy to reach. They really know their stuff (and they’re great folks).

We play nicely with others, including QuickBooks, Xero, and top timekeeping software. And we’ll help you set it up.

Try OnPay out yourself to see how easy payroll and HR can be. To get started, just share a few basic details about your business. Our team of pros will set everything up and import your employees’ information for you.